Minimum monthly salary (MMS) is raised to 1 153 EUR

We would like to inform that the 16th of October 2025 Government of the Republic of Lithuania ruling No. 709 "Regarding the Minimum Wage Applicable in 2026” will come into force as of 1st of January 2026 where minimum monthly salary is raised by 115 EUR – from 1 038 EUR to 1 153 EUR and the hourly wage – from 6,35 EUR to 7,05 EUR.

It is important to note that with this change:

- The amendment will be automatically applied to all employees whose salary is equal to the minimum monthly salary or lower than 1 153 EUR (or, respectively, an hourly rate of 7,05 EUR). The increase in the minimum monthly / hourly wage will also affect these employees’ vacation pay, sick leave pay, and any other payments that are calculated based on the average salary during the period from January to March 2026.

- This decision sets that daily allowance payments for business trips abroad will be tax-exempt only if the employee’s monthly salary is equal to or greater than 1 902,45 EUR or hourly payment is higher than 11,63 EUR / h (11,6325 EUR / h).

- The increase in the SODRA „floor” means that for employees earning less than the minimum monthly salary (MMS)*, the combined social insurance contributions (combined employee and employer) paid to SODRA will rise from 220,78 EUR to 245,24 EUR.

* Please note that the SODRA „floor“ does not apply if the employee works for another employer, receives pension or disability payments, is under 24 years of age, or is insured by the state.

Changes in PIT – a new progressive tax rate is being introduced

From January 1st, 2026, amendments to the law articles IX-1007 of Personal income tax law (further – PIT) will come into force, setting a new PIT rate for residents whose annual income exceeds 36 national monthly average salaries. The amendment replaces Article 6 of the PIT law, and defines that a resident's income will be summed and taxed using the following tax rates:

- 20% - will be applied to income, which does not exceed 36 national monthly average salaries;

- 25% - will be applied to income falling within the range between 36 and 60 national monthly average salaries;

- 32% - will be applied to income which exceeds 60 national monthly average salaries.

Notably, the following types of income will be included in the annual portion of earnings, which will be used to assess the applicable tax rate:

- income from employment relations (salary, bonuses, premiums, benefit in kind, other);

- income from individual activity according to a certificate;

- royalties and remuneration for activities on the supervisory board or board of directors, loan committees;

- author payments from the employer;

- small partnership manager’s income, when the person is not a member of that small partnership;

- annual portion of income from non-individual activities from waste sales exceeding 12 national monthly average salaries;

- annual portion of income received from activities under a business certificate exceeding 50 000 EUR;

- the annual portion of income received not from employment relations, exceeding 12 national monthly average salaries.

Please note that, according to the draft law approving the 2026 indicators for the state social fund budgets, the expected national average monthly salary for 2026 is 2 312,15 EUR. Meanwhile, according to the Lithuanian Ministry of Finance forecasts, the amount is projected to be 2 304,50 EUR.

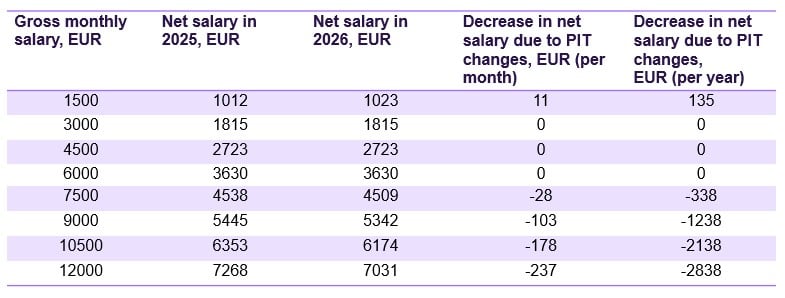

Based on this, preliminary calculations are provided below to illustrate how net salary is expected to change under the PIT regulations applicable in 2025 and 2026.**

** The calculations are based on the average monthly salary equal to 2 312,15 EUR.

Taking the changes into account, please note the following:

- When an individual’s income reaches the threshold of 60 national average monthly salaries, SODRA notifies the person and the employer about the changes in their applicable tax rates. However, no separate notifications are currently planned for having reached the 36 national average monthly salary threshold.

- Once the 60 national average monthly salary point is reached, the obligation to pay State Social Insurance (SSI – 12,52 %) and additional pension accumulation (3 %) contributions ceases. In contrast, when the 36 national average monthly salary threshold is reached, these obligations remain in place.

Tax-exemption for additional health insurance is being reduced

Starting January 1st, 2026, an amendment to Article 17 of the PIT Law (No. IX-1007) will be implemented, narrowing the tax exemption for employer-compensated voluntary health insurance. Under the new rules, the amount paid for such insurance, where coverage applies to healthcare services for the insured individual, may not exceed 350 EUR per tax period, from 2026 onward. Any amount above this limit will no longer qualify as non-taxable income and will be taxed as employment-related earnings.

Please note that in accordance with PIT Law (No. IX-1007), income in kind will be deemed to have been received at the time when the employer makes the contribution. Therefore, under this change, only the (voluntary) health insurance payments made in 2026 and thereafter will be subject to evaluation.

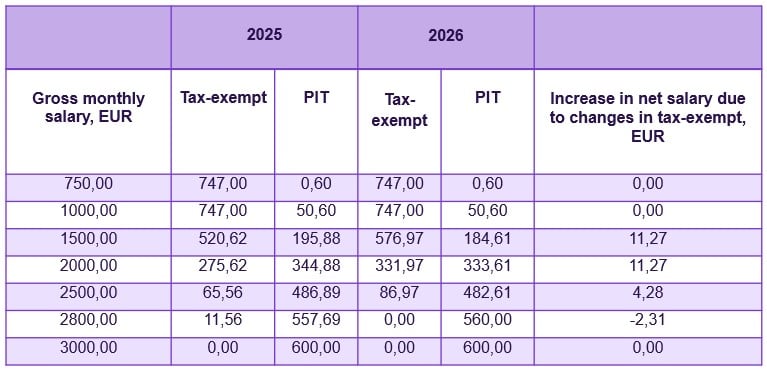

Changes to Tax-Exempt Amount of Income (TEA) – a single formula from 2026

Please note that there are also changes to PIT Law IX-1007 regarding the tax-exempt amount of income. One of the previously applied formulas will be removed, meaning that starting 2026, the tax-exempt amount of income will only apply to salary calculations not exceeding 2 677,49 EUR per month.

Other aspects of the article remain unchanged - the tax-exempt amount of income for the tax period will be applied as follows:

- a person whose monthly income does not exceed the minimum monthly salary valid for the current calendar year (i. e. 1 153 EUR) will have a monthly tax-exempt amount of income equal to 747 EUR;

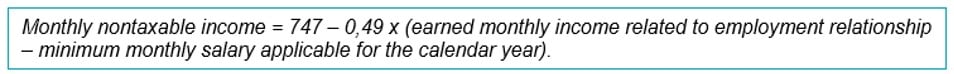

- for a person whose monthly income related to employment or equivalent relationships exceeds the minimum monthly salary applicable for the current calendar year (i. e. 1 153 EUR), but does not exceed 2 677,49 EUR, the following formula will apply:

Considering the changes to the tax-exempt amount of income, the table below showcases PIT calculations for different salary amounts:

No changes to the tax-exempt amount of income are planned for individuals with recognized limited work capacity in 2026. We would like to take this opportunity to remind you that the following amounts have been applicable since 2024:

- individuals with a recognized work capacity of 0-25 % are entitled to a fixed monthly tax-exempt amount of income of 1 127 EUR;

- individuals with a recognized work capacity of 30-55 % are entitled to a fixed monthly tax-exempt amount of income of 1 057 EUR.

Planned changes to make pension accumulation more flexible

From January 1st of 2026, the II pillar pension accumulation system will be updated to become more flexible for the country’s residents: automatic enrollment in the accumulation system will be discontinued, those who are not satisfied with the updated conditions of the II pillar pension accumulation will be allowed to opt out of the system, and those choosing to continue accumulating will be able to pick the optimal contribution amount and, if necessary, to temporarily terminate these additional payments.

A transition period will apply from the 1st of January, 2026, to December 31st, 2027, during which residents will be able to decide whether they would like to remain in the II pillar pension accumulation system or withdraw. To opt out, a request will have to be submitted to the respective pension accumulation company.

Notably, even after the transition period ends, it will still be possible to withdraw a part or all of your accumulated pension contributions, both before reaching retirement age and after, with some terms applicable.

We would also like to highlight that starting January 2026, the Republic of Lithuania will introduce changes to retirement conditions: both the retirement age and the minimum length of service required to qualify for a pension will increase. In addition, the retirement age for men and women will be aligned at 65 years.

Read more:

Lithuania 2026 tax reform. Overview of accepted drafts (26-06-2025)