Key Lithuanian tax changes as of 2022

Changes in corporate taxation

- As of 31 January 2022, the transitional provisions applicable to the United Kingdom (UK) under which UK was treated as an EU Member State will expire and UK will be treated as a non-EU Member State.

- From 1 May 2022, the requirement for companies to account stock on a first-in, first-out (FIFO) basis for income tax purposes is abolished.

- As of 31 January 2023:

- The Law on Corporate Income Tax has been supplemented with a definition of hybrid entities and inclusion to tax base of hybrid entity’s income that was not taxed otherwise;

- The amendment to the law stipulates that in the case of a large investment project relief, the preferential income tax treatment (for income from the use of intellectual property) may be applied only to those who actually carry out research and experimental development activities and subsequently receive income from the use of the relevant intellectual property.

Changes affecting payroll

- Personal income tax law amendments change calculation of non-taxable income from 1stof January, 2022 - two formulas will be used to calculate tax-exempt amount, also fixed tax-exempt values will be altered.

- When gross salary is less than minimum salary as of January 1 (year 2022 – 730 EUR) – fixed monthly non-taxable amount of 460 EUR to be used (previously 400 EUR);

- When gross salary is between 730 EUR and 1678 EUR, the formula shall be:

Monthly non-taxable income = 460 – 0,26 x (earned monthly salary - minimum monthly salary). - When gross salary exceeds EUR 1 678, the following formula shall be applied:

Monthly non-taxable income = 400 – 0,18 × (earned monthly salary – 642).

Accordingly, for gross salaries above 2864 EUR/month, the non-taxable income formula becomes irrelevant / cannot reduce tax liabilities anymore.

- Participants in Pensions savings scheme contribution rate increases from 2,4% to 2,7%. No changes for those whose rate already was 3%.

Changes in the Personal Income Tax

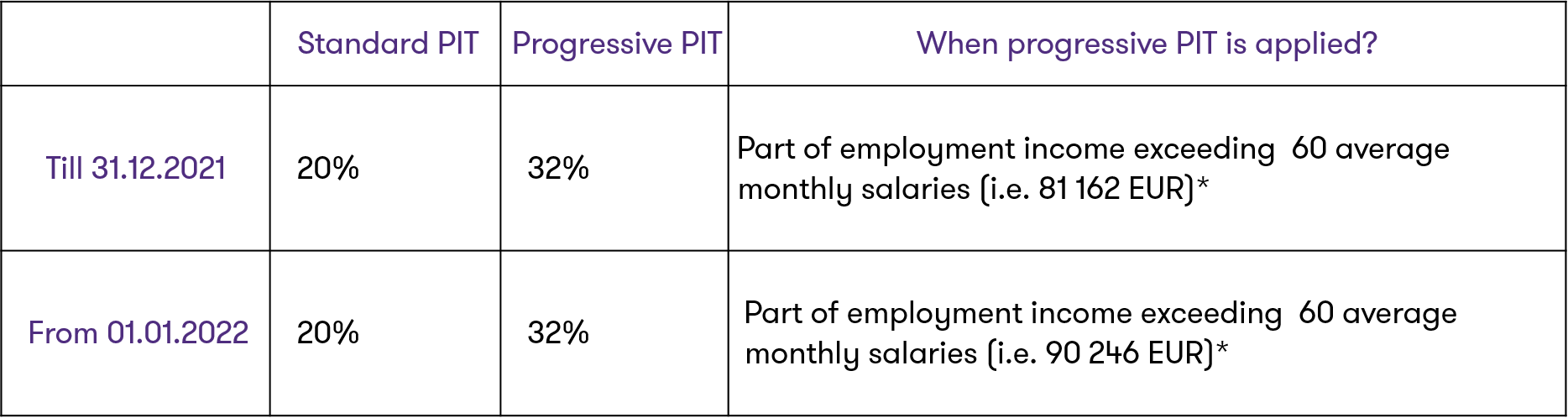

Increase in average wages raises progressive rate threshold from 2022, as shown in the table below.

* Illness, maternity, paternity, parental leave pays and payments from long-term unemployment fund are not included into income from which progressive PIT is calculated.

Increase of excise duties and related changes

- As of 1 January 2022, excise duties were increased, new list of rates is available online here.

- An excise relief for small brewers has been introduced and the concept of heated tobacco and its taxation scheme has been introduced.

- The amended rules for filling in the accounting journal of excise warehouses enter into force.

Changes in the Tax for Environmental Pollution

From 2022 January 1 packaging fees are rising. Instead of the previous single tariff for all types of packaging, different tariffs are set depending on whether the packaging is reusable and recyclable or non-recyclable.

Intrastat reporting changes

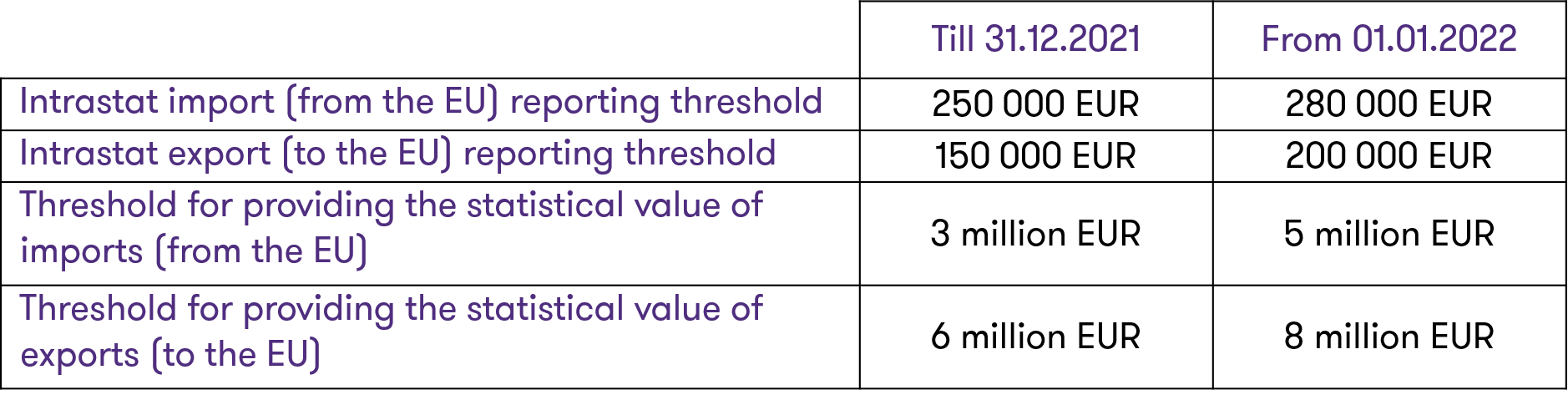

From 1 January 2022, Intrastat reporting thresholds are increasing, as shown in the table below.

Changes in tax administration

- Payment service providers will be required to collect, store and provide data on cross-border payment transactions to the tax administrator from 2024 onwards.

- For all taxpayers, from 2023 there will be an obligation to record the data of payments for goods and services sold or purchased.

Changes in regulation on crowdfunding interest income

As of 10 November 2022, the Law on Crowdfunding is repealed. Accordingly, the tax relief for interest provided through the crowdfunding platform will no longer be subject to local regulations, but directly to the to the Regulation of the European Parliament and of the Council of 7 October 2020 (EU) No 2020/1503. It should be noted that the Regulation provide a transitional period of one year (until 9 November 2022) during which operators of crowdfunding platforms may continue to provide services under national law or start providing services under the Regulation as soon as they have been authorized.

Future tax reforms are expected

The Ministry of Finance is preparing a draft tax reform, which it intends to publish for public consultation in the first half of 2022, with a view to entry into force from 2023.

Expected changes:

- The Real Estate Tax Base is likely to expand;

- The tax burden on self-employed persons is likely to increase;

- Income tax, Personal income tax and similar reliefs are likely to be eliminated or reduced.